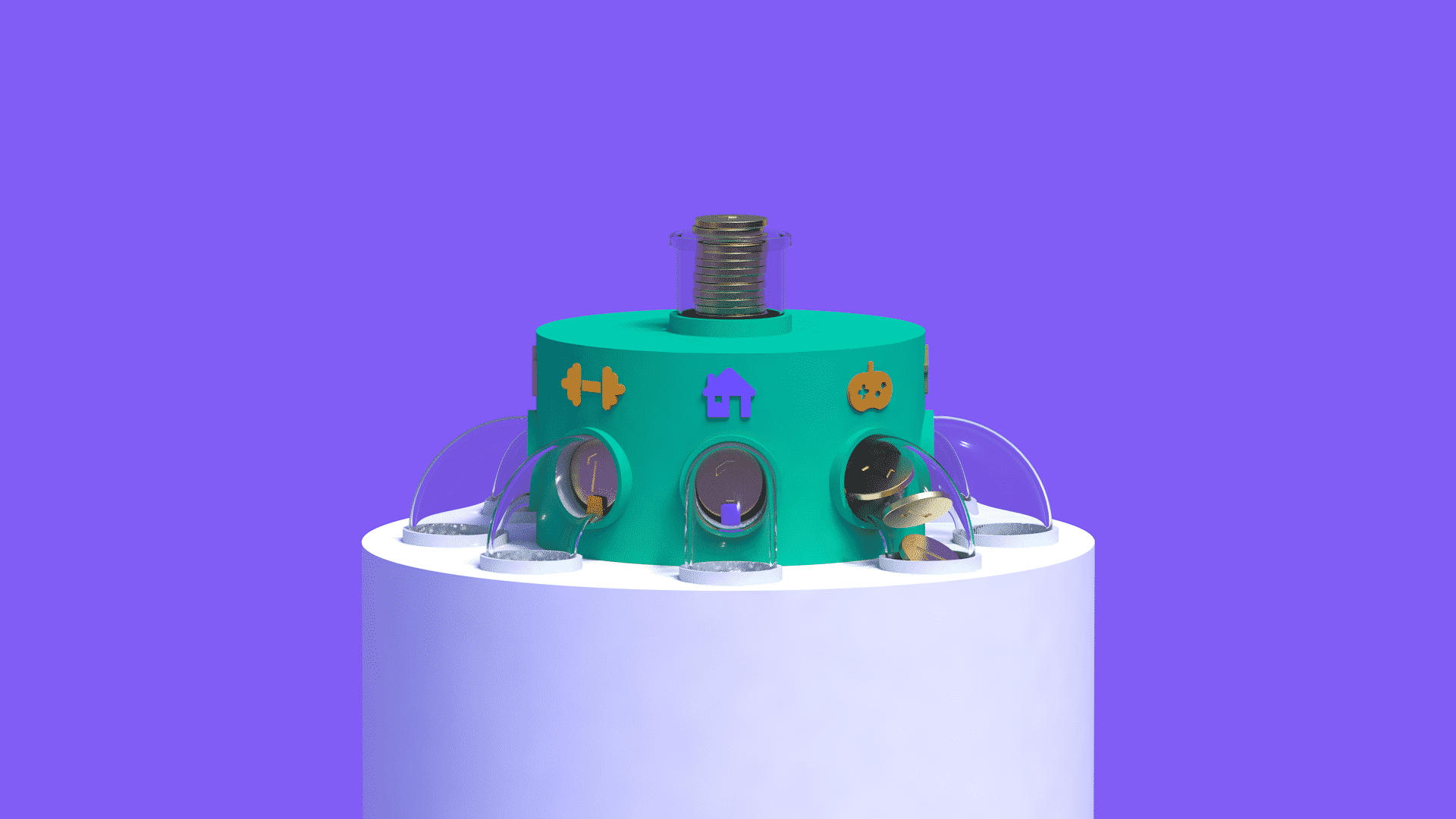

London-based fintech startup, Revolut, has announced the launch of ‘Pockets’ – a new feature that enables customers to stay on top of their spending as well as makes organising rent, bills, and subscriptions effortless, as claimed by the company.

Customers can set aside their money into Pockets for their buying needs. Thereby ensuring they don’t accidentally spend their rent.

“If customers already have scheduled payments set up with Revolut, then all they need to do is create their Pockets for their various subscriptions and bills, then sort their bills into them. Revolut will make sure that they are paid when they’re due,” claims the company.

And in this way, customers can automatically put money aside for bills by setting up recurring funding on payday into their Pockets, so their bills money is automatically set aside, and the customers are left only with their balance which can be spent or saved freely.

The scheduled payments, in a way, will help customers to never miss out on any payments. “We understand how difficult it is to stay on top of all your various bills and subscriptions. With our new feature Pockets, we’re helping our customers manage all their finances in one place and get on top of their spending once and for all,” says, Marsel Nikaj, head of savings at Revolut.

Earlier this month, Revolut had launched its online Web App for its userbase of 13 million customers. The Web App is believed to let customers access their accounts safely from a web browser besides the smartphone app. According to the company, there is two-factor authentication to securely sign in to the Revolut Web App.

In November, the London-based company launched Google Pay for its customers, to be among the first financial services companies to provide Google Pay as a service within its app.