Curve is an excellent choice if you use many different bank cards but don’t want to carry all of them everywhere. It will not replace your bank, but could replace all your bank cards. Curve supports cards of many currencies and also follows fee-free foreign spending, while useful additional feature are being added continuously.

This card is a bit different than the others. I like the concept this company has come up with and, in this case, their unique idea. Curve Card is a British (physical) payment card, which is smarter than Your regular card issued by banks. Main function of this card is to pair all Your current payment cards into one, Curve. This will help You save wallet space. If You own only two cards, it may not be of such use to You, but in case You are using three or more cards, You will greatly appreciate this gadget. Even though Curve Card is issued by a British company, it fully supports most world’s banks cards. I can confirm following ones which I have personally tested: Revolut, Monese, A1 Wallet, Central Cooperative Bank, DSK Bank and Bunq.

Curve pros and cons

Pros

- Unique services, like using all your cards in one, Anti-Embarrassment Mode and going back in time

- Premium subscription options with handy perks

- Easy-to-use app with good user experience

Cons

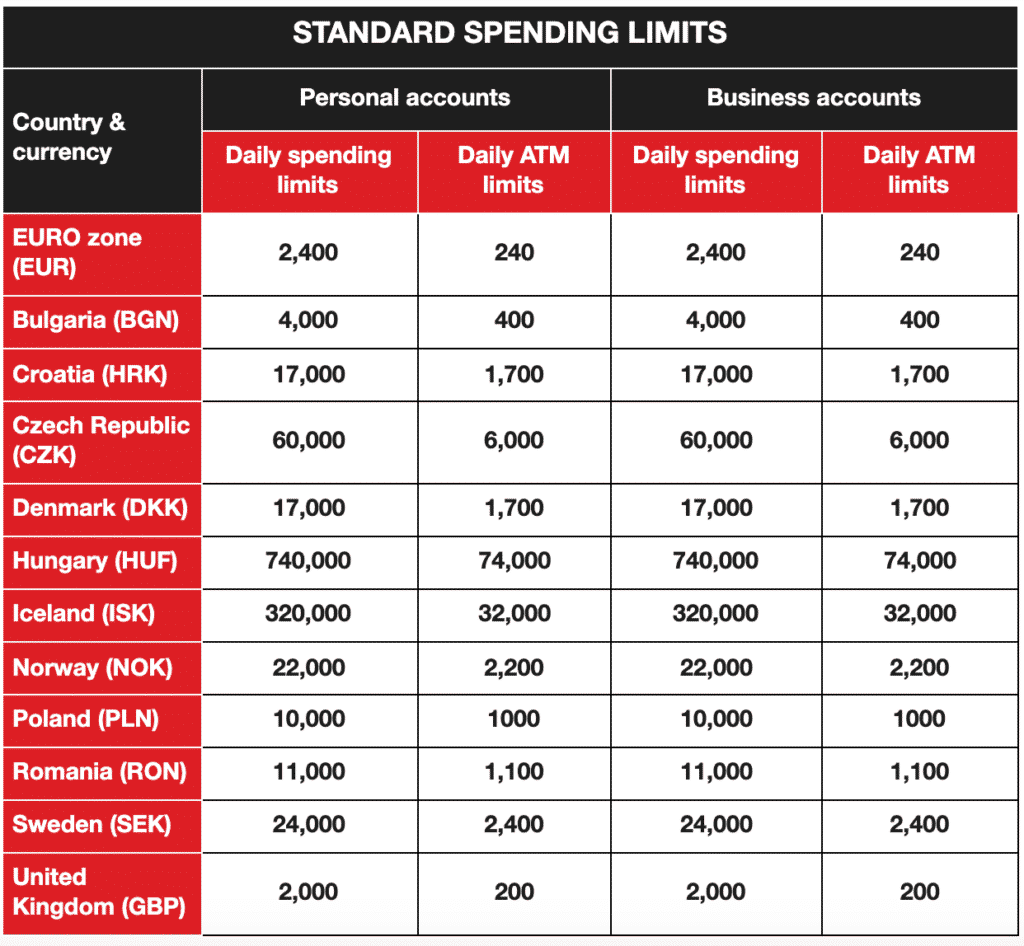

- Monthly and daily limits on ATM withdrawals, spending

- Lacks budgeting and savings features

- Customer support is relatively slow, although helpful

What are the Curve Card limits?

Irrespective of the limits on your underlying cards, Curve has its own daily, monthly and annual limits. Your limits are increased as Curve begins to ‘trust’ your behaviour.

These are the maximum limits you can get according to the website, although some people have been given more:

You may not get this limit from Day 1 but, as you begin to use the card, your limits will be increased.

What are the three different types of Curve Card?

There are three different Curve Cards you can get:

The basic Curve Card (Curve Blue) is FREE – in fact Curve will pay you £5 for trying it out if you use my referral code of D4WPOBJE

Curve Black costs £9.99 per month and allows unlimited foreign exchange recharging and provides some travel and insurance benefits

Curve Metal costs £14.99 per month or £150 per year and has a choice of three cool metal cards to choose from, allows unlimited foreign exchange recharging, pay-per-use airport lounge access and a broader range of travel and insurance benefits

How to apply for your Curve Card (free if you choose Blue)

To sign up to Curve, simply go to this page of their website or download the app (available for Android and iOS). The easiest thing to do is order the free Blue card and then upgrade to Black or Metal once you have got familiar with it, although you can start immediately on Black or Metal if you want.

Curve will pay you £5 for trying it out if you use my referral code of D4WPOBJE – a £5 cash credit will be added to your Curve Rewards balance. If you click through via the link above (or here) and then download the app it should track automatically. Alternatively include the code when you add your personal details to the app.

Tip for getting a bonus faster: You don’t have to wait for the physical card to arrive. You can make the first transaction in the online store.

How do I get Curve Card for free + £5 bonus?

To get Your Card for free (along with shipping) and the additional £5 bonus, all You need to do is use the PROMO code D4WPOBJE while setting up Your account.

What is a Curve payment card?

Main function of this card is to pair all Your current payment cards into one, Curve. This will help You save wallet space. If You own only two cards, it may not be of such use to You, but in case You are using three or more cards, You will greatly appreciate this gadget.

Is using Curve Card free?

Yes, both; keeping of the Card and all Card payments are free of charge. The company makes their money on fees from the businesses, with each Card purchase You make.

Can I add Curve Card to Apple Pay, Google Pay or Samsung Pay?

Yes! You can add your Curve Card to any of those options! Any card you add to Curve works with Apple Pay, Google Pay and Samsung Pay so you can drop the wallet completely, and start living card-free.

Can I add Curve Card to smartwatch?

If you’re a UK customer or in the EEA, a selection of our cards can also be used with Garmin Pay, Fitbit Pay and Wena Pay.

Can I use Curve like my normal bank card?

Yes! You can spend with Curve in-store, online and at ATMs at home or abroad, anywhere Mastercard® is accepted.

Can I use Curve at ATMs?

Yes, you can absolutely use your Curve card to withdraw cash at any ATM that supports Mastercard® cards. These will be subject to limits similar to your normal spending limits.

How Curve Card works?

You can easily link your card to Curve mobile app and then go on to do your shopping. When you use your Curve Card for payment, the transaction price will be deduced from your selected card. You accidentally paid with the wrong card? Just Go Back in Time and switch to a different card, for up to 14 days back.

How to get 1 % instant cashback if you choose Blue Card?

Choose 3 from 50 favourite brand shops and you get instant cashback 1 % for 90 days. For example: Shell, IKEA, Lidl, Tesco etc.

How to top–up a Curve Card?

No top ups needed. With Curve Card you just link all your cards to the Curve app, and then pay with your Curve card. Great solution!